Trust Inherited Ira Distribution Rules 2024 – New rules for inherited IRAs could leave some heirs with a hefty tax bill. In the first quarter of 2023, Americans held more than $12 trillion in IRAs. If your parents saved diligently throughout . You can unintentionally forfeit the entire tax-free distribution if specific rules aren’t followed Second, the account must be an eligible account type. Traditional IRAs, Rollover IRAs, and .

Trust Inherited Ira Distribution Rules 2024

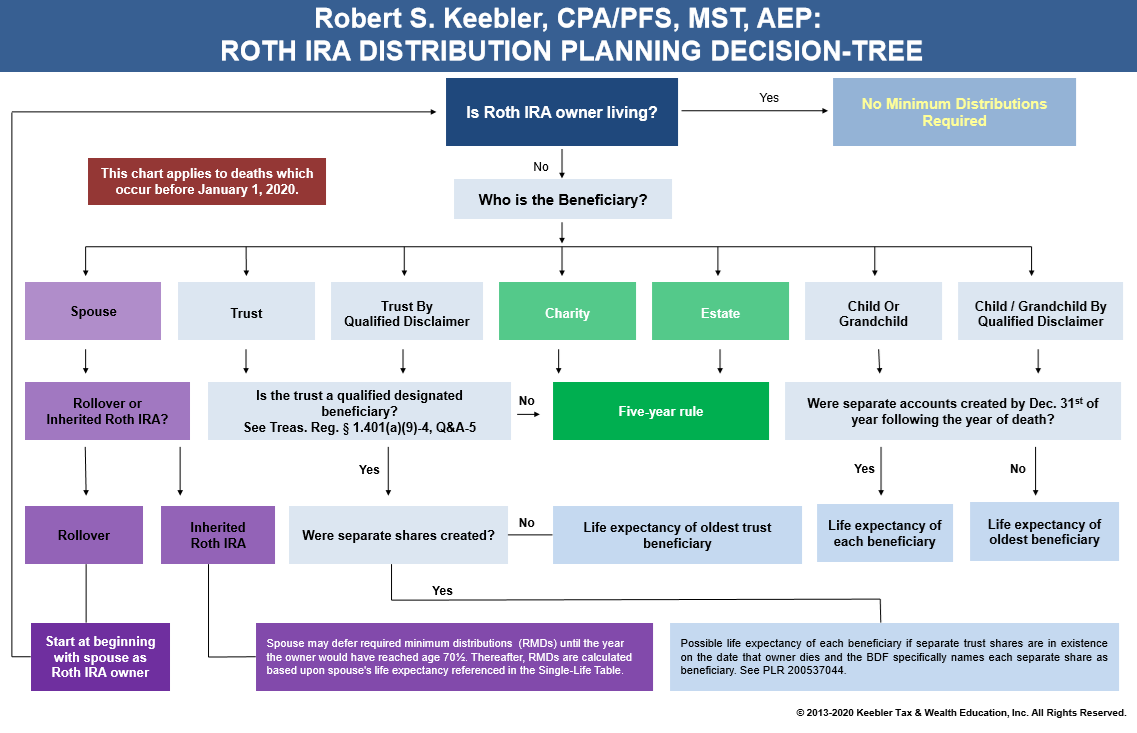

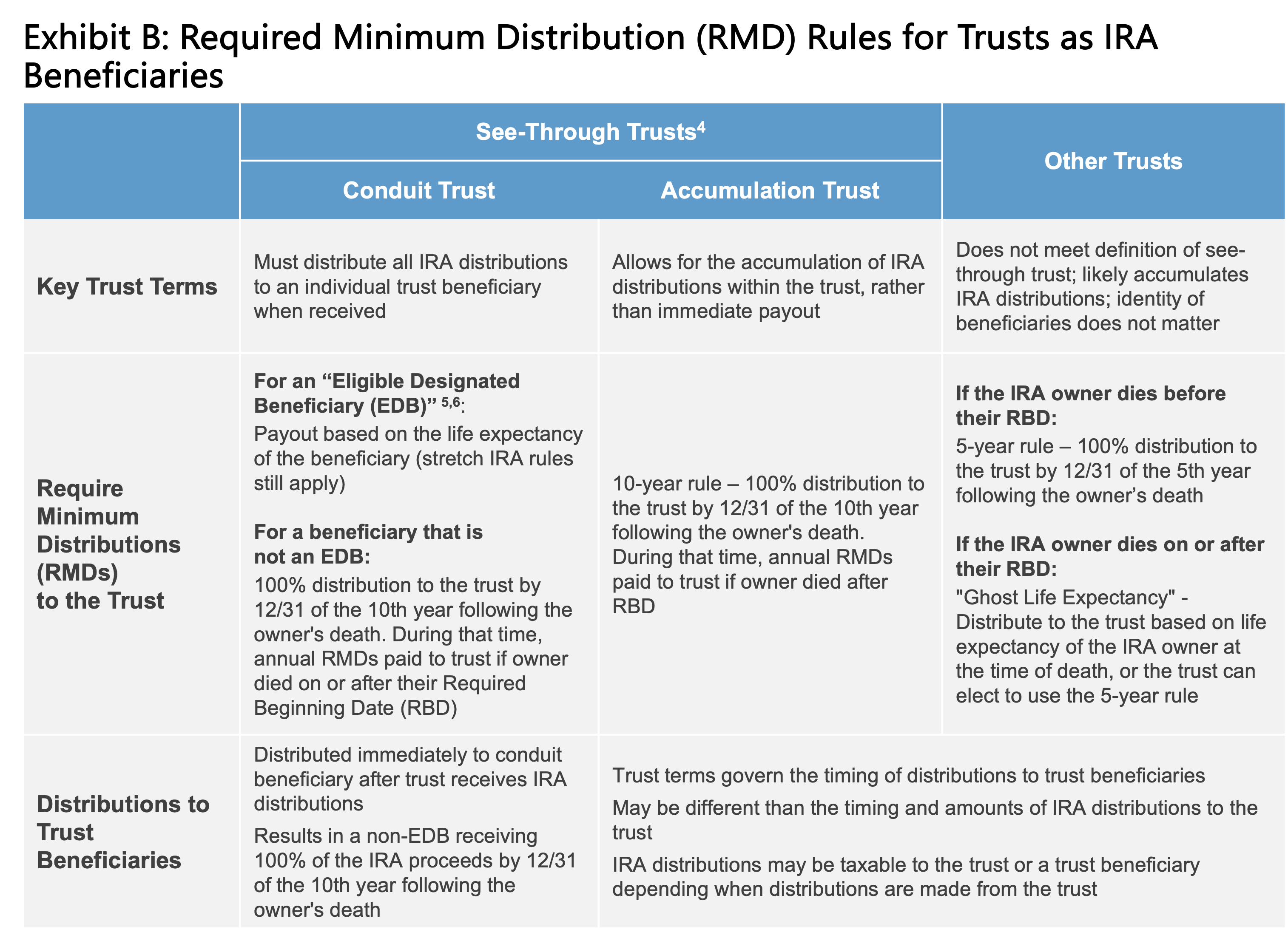

Source : ultimateestateplanner.comNaming a Trust as IRA Beneficiary: Key Considerations Fiduciary

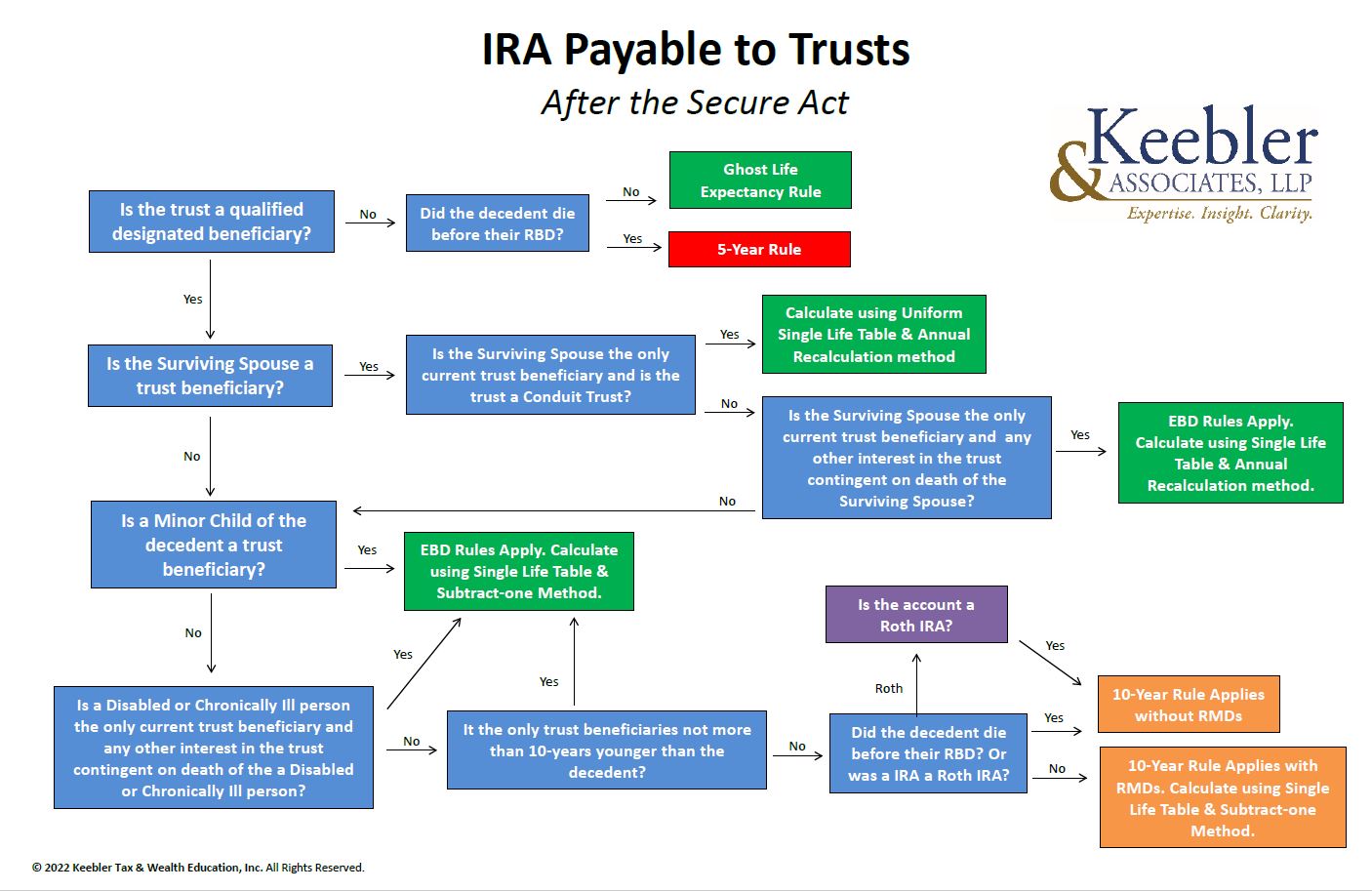

Source : www.fiduciary-trust.com2024 IRA Payable to Trusts After the Secure Act Chart Ultimate

Source : ultimateestateplanner.comNaming a Trust as IRA Beneficiary: Key Considerations Fiduciary

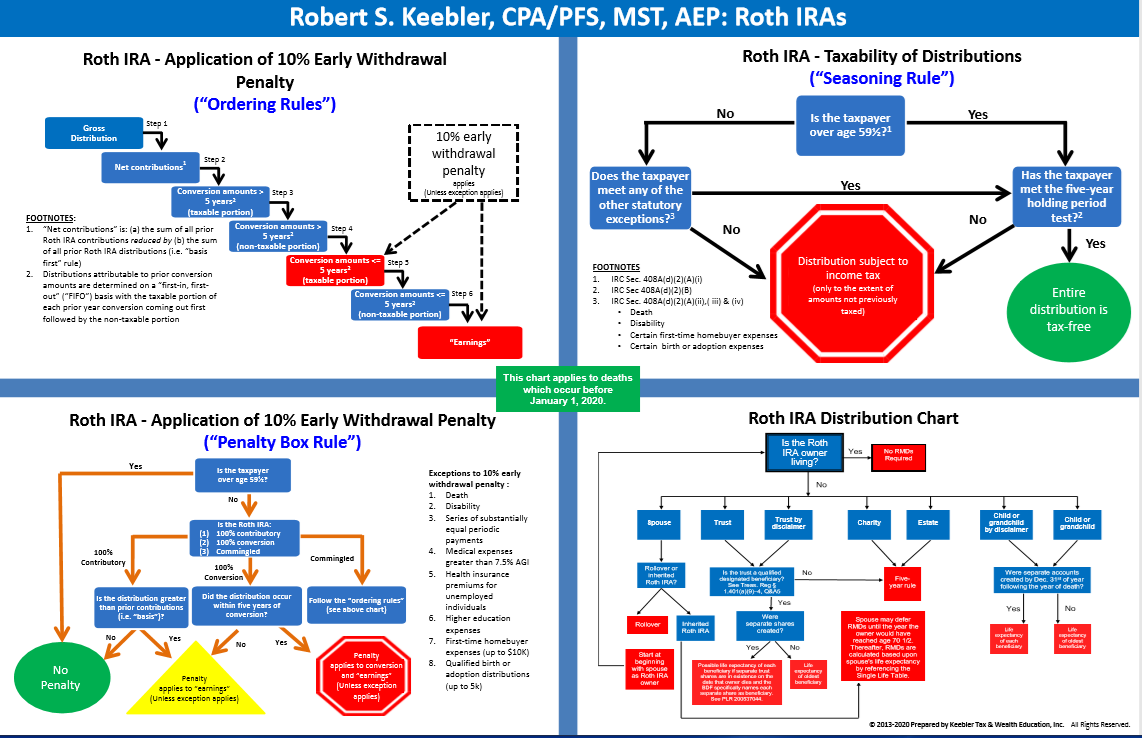

Source : www.fiduciary-trust.comThe Roth IRA Quadrants Chart 2024 Ultimate Estate Planner

Source : ultimateestateplanner.comSuccessor Beneficiary RMDs After Inherited IRA Beneficiary Passes

Source : www.kitces.comYour 2024 IRA Calendar » STRATA Trust Company

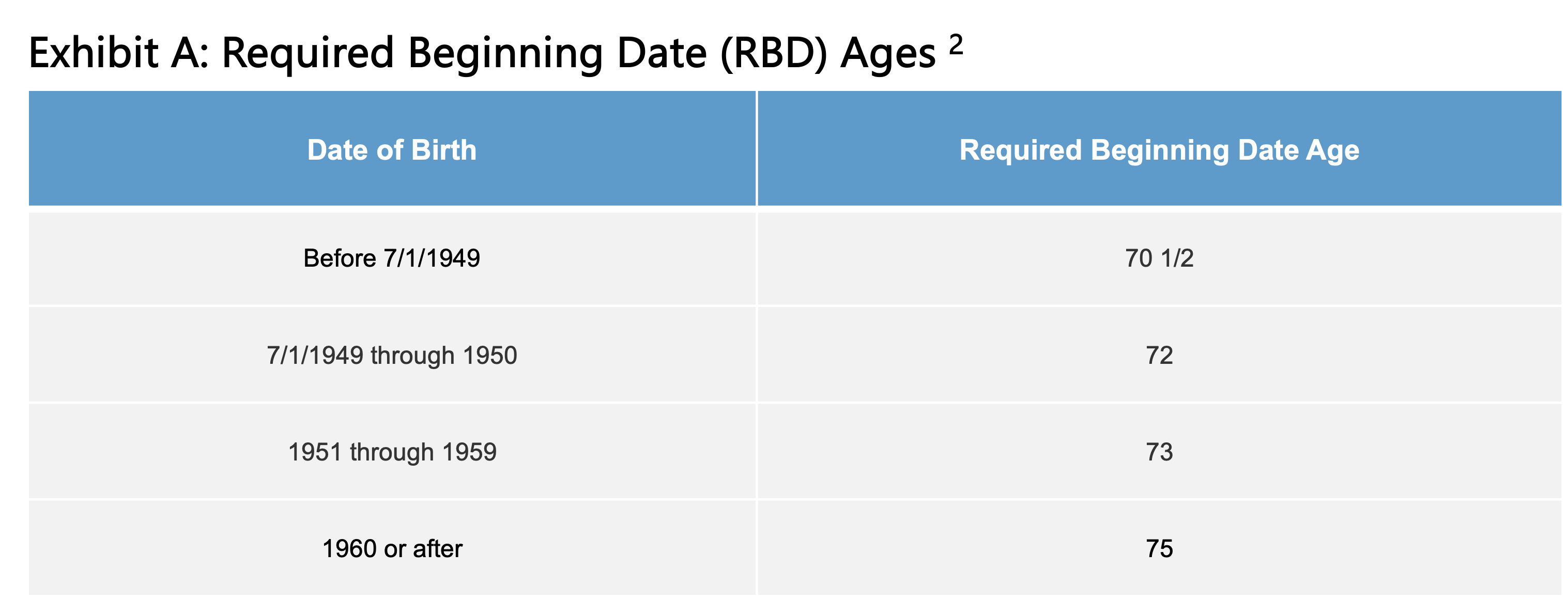

Source : www.stratatrust.comSECURE 2.0 Act: How It Affects You and Your Retirement Account

Source : www.themckenziefirm.comThe Impact Of New IRS Proposed Regulations On The SECURE Act

Source : www.kitces.comThe Basics of Inherited IRAs Adviser Investments

Source : www.adviserinvestments.comTrust Inherited Ira Distribution Rules 2024 2024 Roth IRA Distribution Chart Ultimate Estate Planner: If you inherited an IRA, and you’re the spouse of the original owner, you have one set of choices. If you’re a minor child, chronically ill or disabled, or not more than 10 years younger than the . And keep in mind that the IRS has delayed some rules and penalties for certain inherited IRAs. Understanding the tax treatment of distributions and inherited IRA RMD rules is crucial for IRA .

]]>